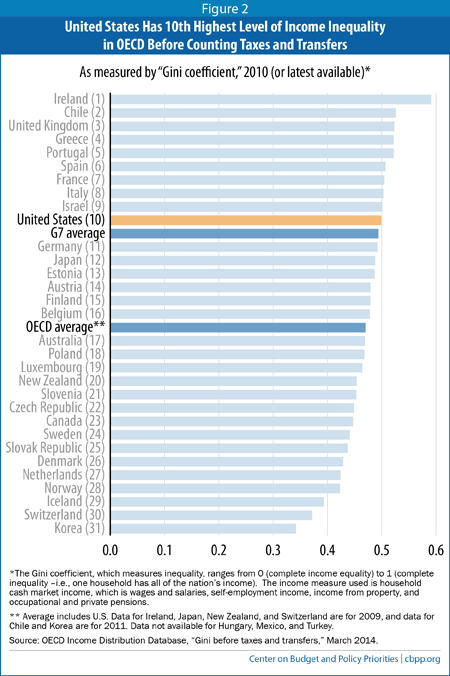

What Do OECD Data Really Show About U.S. Taxes and Reducing Inequality? | Center on Budget and Policy Priorities

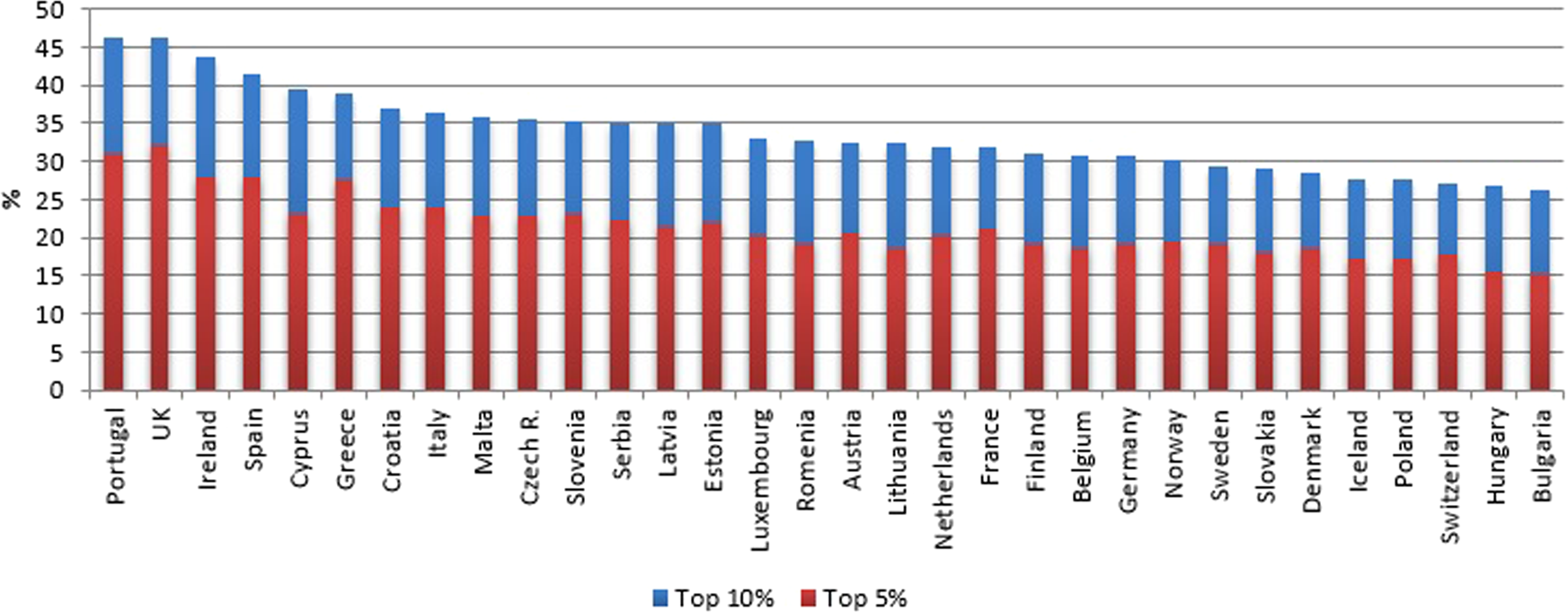

Four profiles of inequality and tax redistribution in Europe | Humanities and Social Sciences Communications

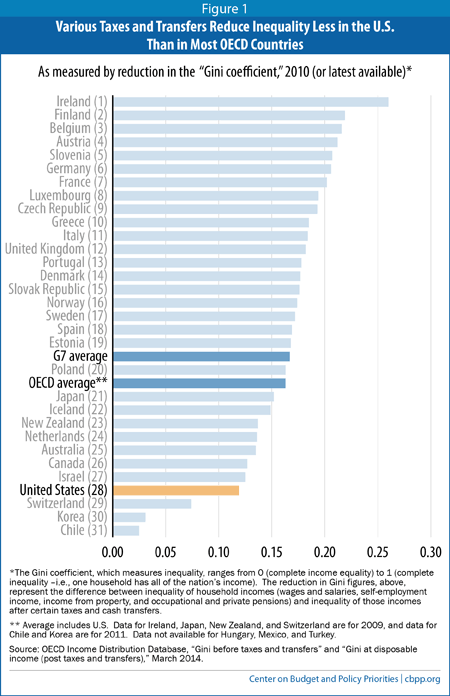

What Do OECD Data Really Show About U.S. Taxes and Reducing Inequality? | Center on Budget and Policy Priorities

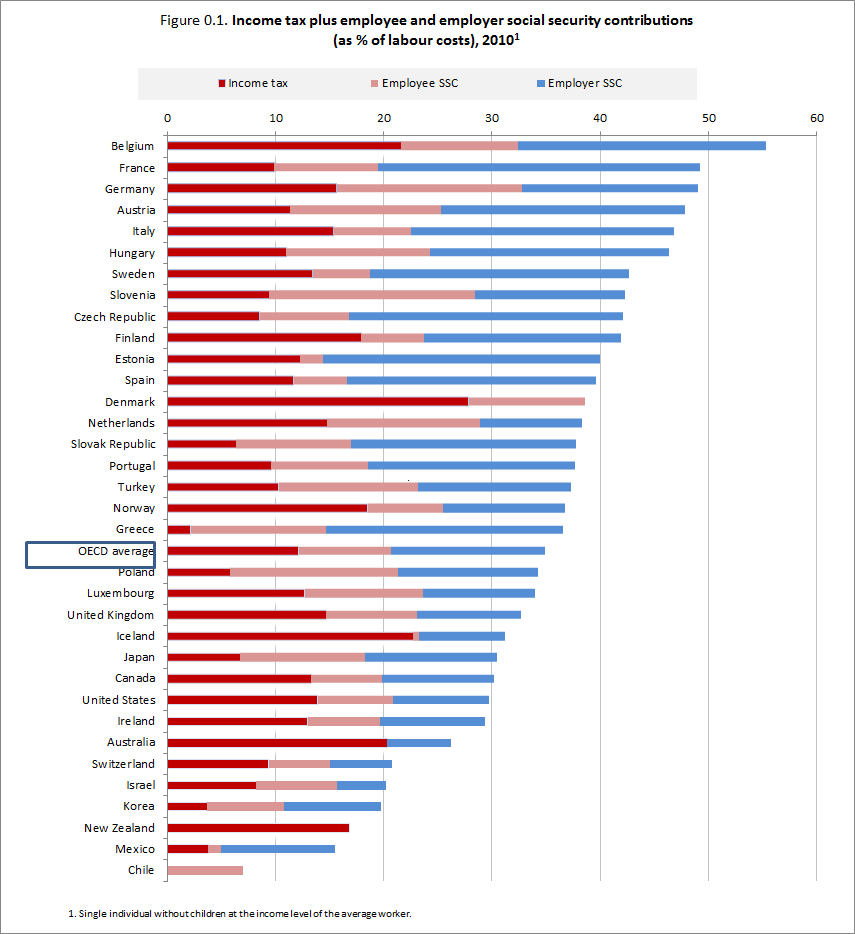

OECD ➡️ Better Policies for Better Lives on Twitter: "As a percentage of labour costs, total employee and employer social security contributions exceeded 20% in 23 OECD countries. Learn more ➡️ https://t.co/CGpKREOVgE #

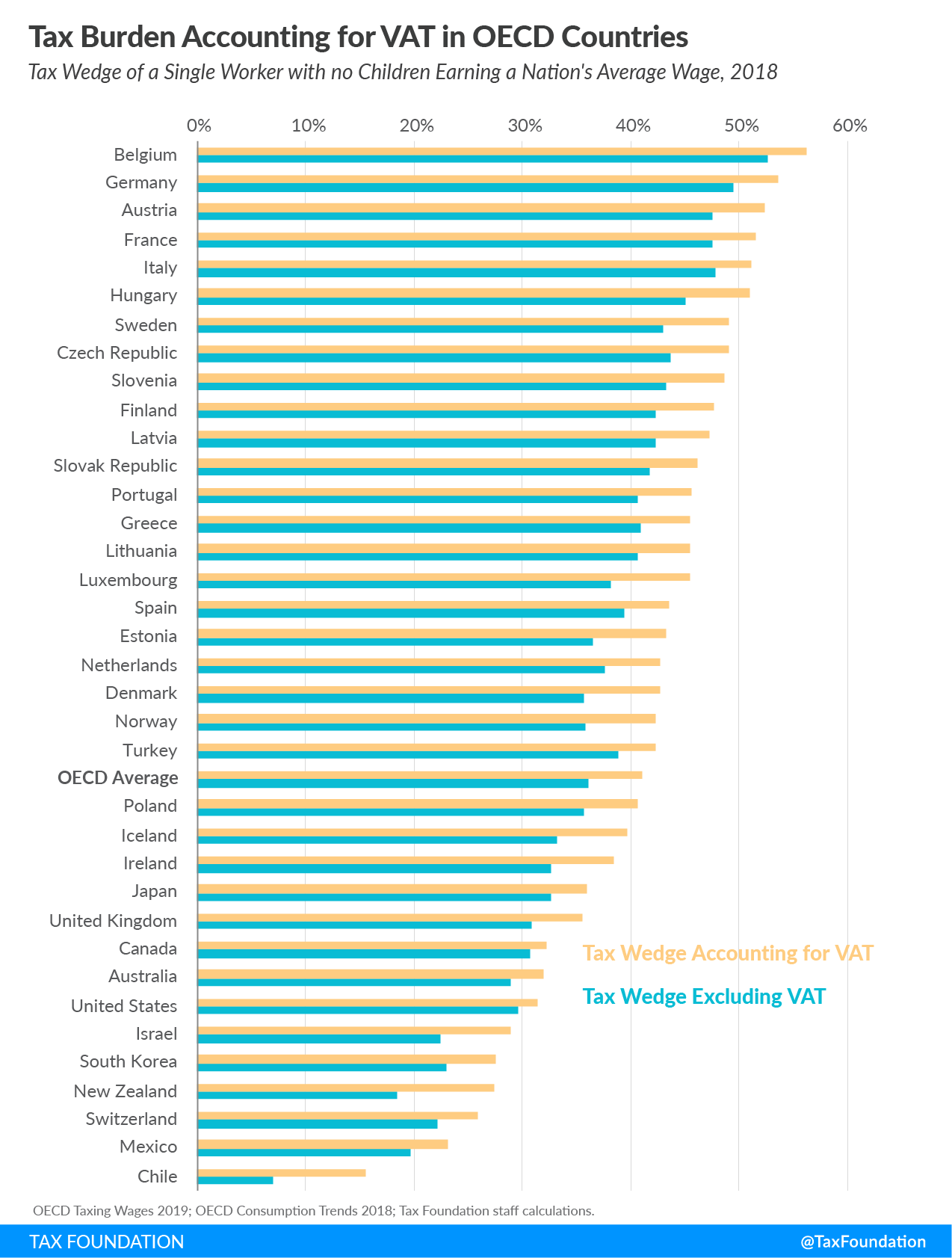

1. Overview | Taxing Wages 2022 : Impact of COVID-19 on the Tax Wedge in OECD Countries | OECD iLibrary